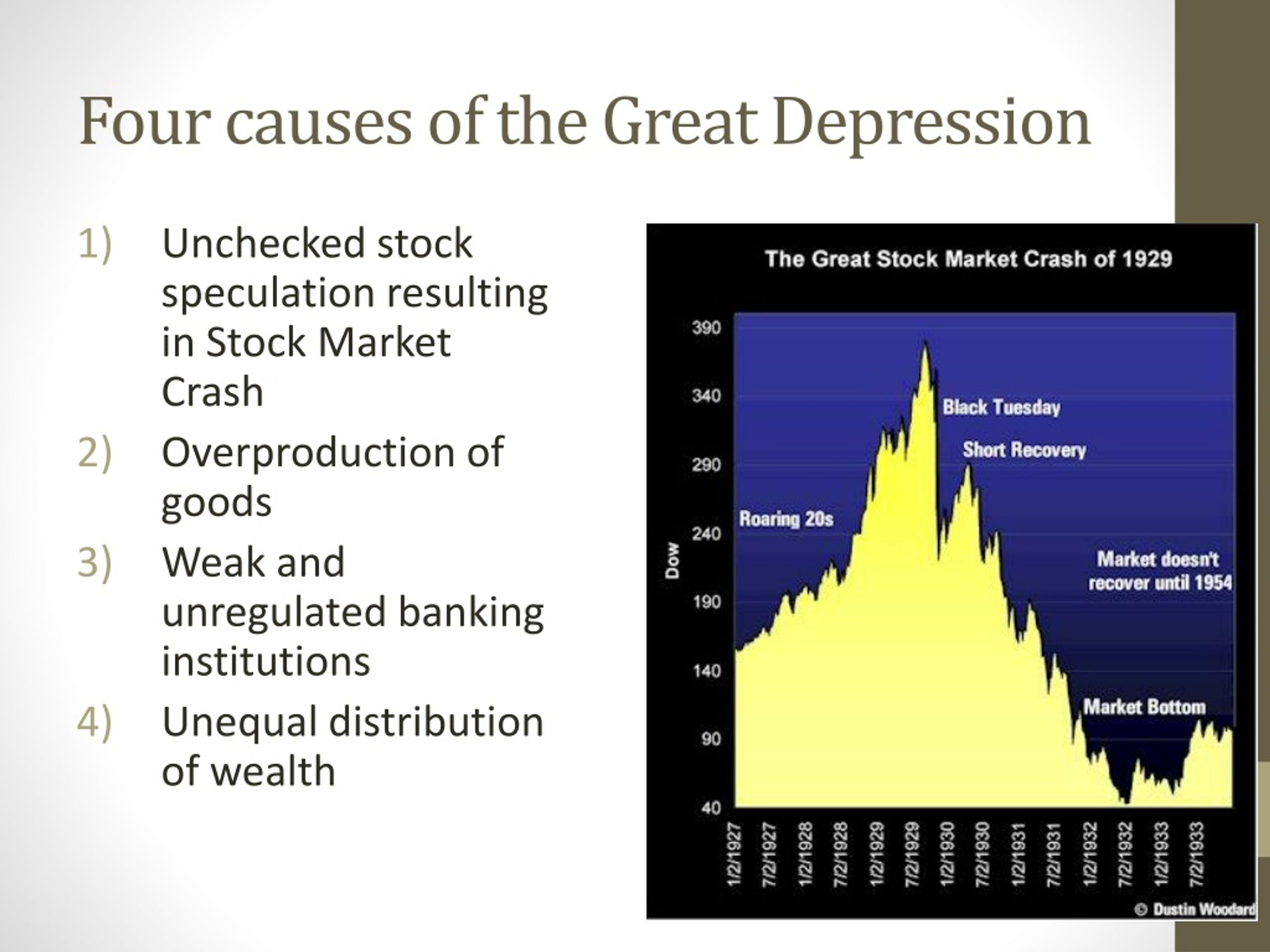

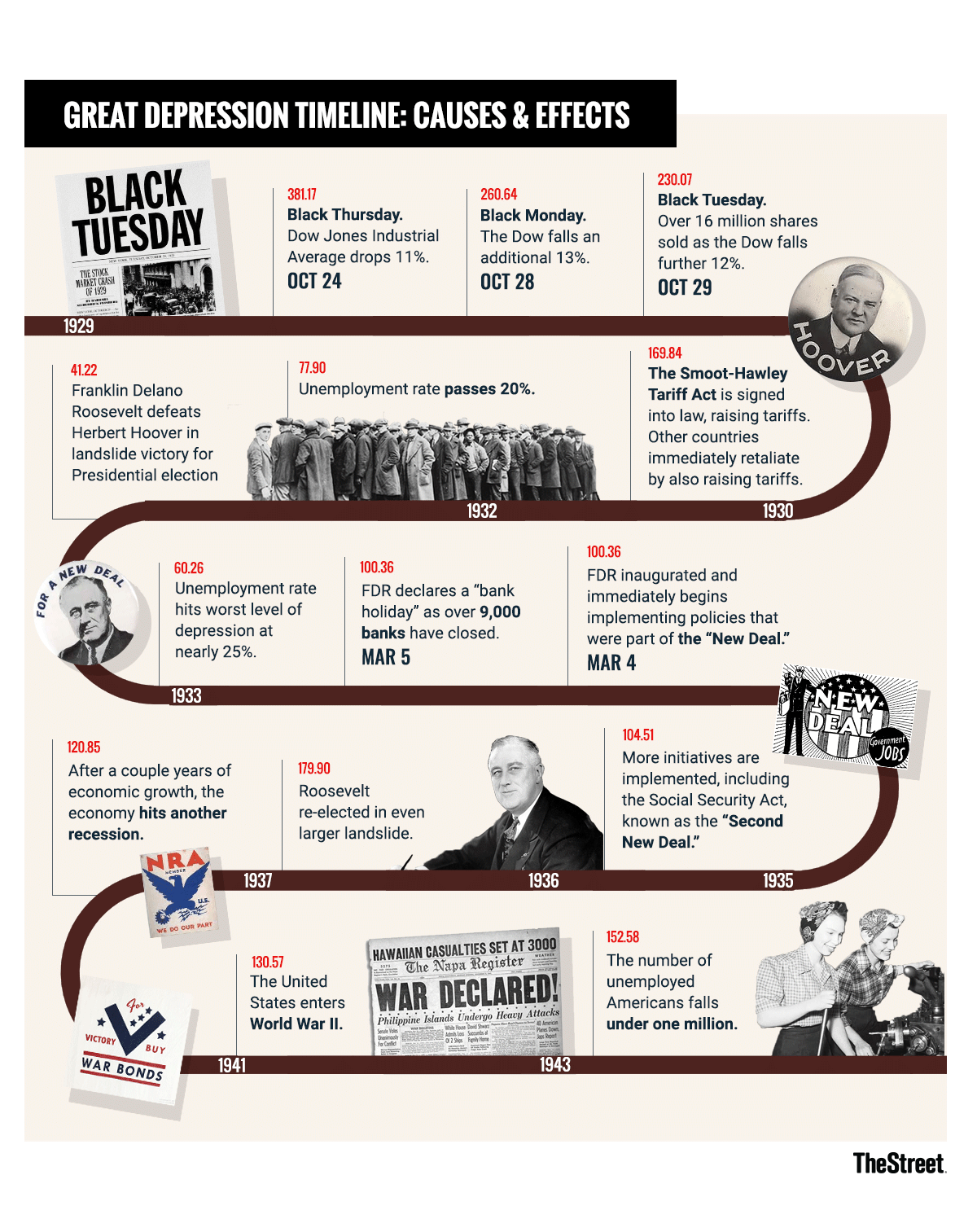

May 27, · The Great Depression was a worldwide economic depression that lasted 10 years. The depression was caused by the stock market crash of and the Fed’s reluctance to increase the money supply. GDP during the Great Depression fell by half, limiting economic movement There are various explanations for the causes of the great depression that started in Some of the most likely causes are given below: 1. OVER-PRODUCTION AND OVER-EXPANSION During the decade of the Roaring Twenties, many industries expanded their production beyond blogger.com money was spent adding factories and building new onesThere was an over-production of Apr 16, · The Lesson. The Crash of was the impetus for the Great Depression, but it was the preexisting economic conditions - far more widely spread than the number of individual investors, that caused the downward spiral that doomed Herbert Hoover’s presidency

Causes of the Great Depression | SchoolWorkHelper

The causes of the Great Depression in the early 20th century in the USA have been extensively discussed by economists and remain a matter of active debate, causes of the great depression. The specific economic events that took place during the Great Depression are well established. There was an initial stock market crash that triggered a "panic sell-off" of assets.

This was followed by a deflation in asset and commodity prices, dramatic drops in demand and credit, and disruption of trade, causes of the great depression resulting in widespread unemployment over 13 million people were unemployed by and impoverishment. However, economists and historians have not reached a consensus on the causal relationships between various events and government economic policies in causing or ameliorating the Depression. Current mainstream theories may be broadly classified into two main points of view.

The first are the demand-driven theories, from Keynesian and institutional economists who argue that the depression was caused by a widespread loss of confidence that led to drastically causes of the great depression investment and persistent underconsumption.

Causes of the great depression demand-driven theories argue that the financial crisis following the crash led to a sudden and persistent reduction in consumption and investment spending, causing the depression that followed.

Holding money therefore became profitable as prices dropped lower and a given amount of money bought ever more goods, exacerbating the drop in demand.

Second, there are the monetaristswho believe that the Great Depression started as an ordinary recession, but that significant policy mistakes by monetary authorities especially the Federal Reserve caused a shrinking of the money supply which greatly exacerbated the economic situation, causing a recession to descend into the Great Depression.

There are also several various heterodox theories that reject the explanations of the Keynesians and monetarists. Some new classical macroeconomists have argued that various labor market policies imposed at the start caused the length and severity of the Great Depression. The two classical competing theories of the Great Depression are the Keynesian demand-driven and the monetarist explanation. There are also various heterodox theories that downplay or reject the explanations of the Keynesians and monetarists.

Economists and economic historians are almost evenly split as to whether the traditional monetary explanation that monetary forces were the primary cause of the Great Depression is right, or the traditional Keynesian explanation that a fall in autonomous spending, particularly investment, is the primary explanation for the onset of the Great Depression. There is consensus that the Federal Reserve System should have cut short the process of monetary deflation and banking collapse, causes of the great depression.

If the Fed had done that, the economic downturn would have been far less severe and much shorter. In his book The General Theory of Employment, Interest and MoneyBritish economist John Maynard Keynes introduced concepts that were intended to help explain the Great Depression. He argued that there are reasons that the self-correcting mechanisms that many economists claimed should work during a downturn might not work.

One argument for a non-interventionist policy during a recession was that if consumption fell due to savings, the savings would cause the rate of interest to fall. According to the classical economists, lower interest rates would lead to increased investment spending and demand would remain constant. However, Keynes argues that there are good reasons that investment does not necessarily increase in response to a fall in the interest rate.

Businesses make investments based on expectations of profit. Therefore, if a fall in consumption appears to be long-term, businesses analyzing trends will lower expectations of future sales. Therefore, the last thing they are interested in doing is investing in increasing future production, even if lower interest rates make capital inexpensive. In that case, the economy can be thrown into a general slump due to a causes of the great depression in consumption. This view is often characterized by economists as being in opposition to Say's Law.

The idea that reduced capital investment was a cause of the depression is a central theme in secular stagnation theory. Keynes argued that if the national government spent more money to help the economy to recover the money normally spent by consumers and business firms, then unemployment rates would fall.

The solution was for the Federal Reserve System to "create new money for the national government to borrow and spend" and to cut taxes rather than raising them, in order for consumers to spend more, and other beneficial factors.

Keynes proclaimed that more workers could be employed by decreasing interest rates, encouraging firms to borrow more money and make more products.

Employment would prevent the government from having to spend any more money by increasing the amount at which consumers would spend. Keynes' theory was then confirmed by the length of the Great Depression within the United States and the constant unemployment rate. Employment rates began to rise in preparation for World War II by increasing government spending. In their book A Monetary History of the United States, —Milton Friedman and Anna Schwartz laid out their case for a different explanation of the Great Depression.

Essentially, the Great Depression, in their view, was caused by the fall of the money supply. Friedman and Schwartz write: "From the cyclical peak in August to a cyclical trough in Marchthe stock of money fell by over a third. Friedman and Schwartz argue that people wanted to hold more money than the Federal Reserve was supplying. As a result, people hoarded money by consuming less. This caused a contraction in employment and production since prices were not flexible causes of the great depression to immediately fall.

The Fed's failure was in not realizing what was happening and not taking corrective action. I would like to say to Milton and Anna: Regarding the Great Depression, you're right. We did it. We're very sorry. But thanks to you, we won't do it again. After the Depression, the primary explanations of it tended to ignore the importance of the money supply. However, in the monetarist view, the Depression was "in fact a tragic testimonial to the importance of monetary forces", causes of the great depression.

They did not claim the Fed caused the depression, only that it failed to use policies that might have stopped a recession from turning into a depression.

Before the Great Depression, causes of the great depression, the US economy had already experienced a number of depressions. These depressions were often set causes of the great depression by banking crisis, the most significant occurring in,and such as in the Panic of by suspending the convertibility of deposits into currency, causes of the great depression. Starting inthere were growing efforts by financial institutions and business men to intervene during these crises, providing liquidity to banks that were suffering runs.

During the banking panic ofan ad hoc coalition assembled by J. Morgan successfully intervened in this way, thereby cutting off the panic, which was likely the reason why the depression that would normally have followed a banking panic did not happen this time. A call by some for a government version of this solution resulted in the establishment of the Federal Reserve.

But in —32, the Federal Reserve did not act to provide liquidity to banks suffering bank runs. In fact, its policy contributed causes of the great depression the banking crisis by permitting a sudden contraction of the money supply. During the Roaring Twentiesthe central bank had set as its primary goal "price stability", causes of the great depression, in part because the governor of the New York Federal Reserve, Benjamin Strongwas a disciple of Irving Fishera tremendously popular economist who popularized stable prices as a monetary goal.

It had kept the number of dollars at such an amount that prices of goods in society appeared stable. InStrong died, and with his death this policy ended, to be replaced with a real bills doctrine requiring that all currency or securities have material goods backing them. This policy permitted the U. money supply to fall by over a third from to When this money shortage caused runs on banks, the Fed maintained its true bills policy, refusing to lend money to the banks in the way that had cut short the panic, instead allowing each to suffer a catastrophic run and fail entirely.

This policy resulted in a series of bank failures in which one-third of all banks vanished. Consequently, the banking panics of, and might not have happened, just as suspension of convertibility in and had quickly ended the liquidity causes of the great depression at the time. Monetarist explanations had been rejected in Samuelson's work Economicswriting "Today few economists regard Federal Reserve monetary policy as a panacea for controlling the business cycle.

Purely causes of the great depression factors are considered to be as much symptoms as causes, albeit symptoms with aggravating effects that should not be completely neglected. The monetary explanation has two weaknesses. First, it is not able to explain why the demand for money was falling more rapidly than the supply during the initial downturn in — These questions are addressed by modern explanations that build on the monetary explanation of Milton Friedman and Anna Schwartz but add non-monetary explanations.

Total debt to GDP levels in the U. This level of debt was not exceeded again until near the end of the 20th century. Jerome gives an unattributed quote about finance conditions that allowed the great industrial expansion of the post WW I period:. Probably never before in this country had such a volume of funds been available at such low rates for such a long period.

Furthermore, Jerome says that the volume of new capital issues increased at a 7. There was also a real estate and housing bubble in the s, especially in Florida, which burst in Irving Fisher argued the predominant factor leading to the Great Depression was over-indebtedness and deflation. Fisher tied loose credit to over-indebtedness, causes of the great depression, which fueled speculation and asset bubbles. The chain of events proceeded as follows:.

When the market fell, brokers called in these loans, which could not be paid back. Banks began to fail as debtors defaulted on debt and depositors attempted to withdraw their deposits en masse, triggering multiple bank runs.

Government guarantees and Federal Reserve banking regulations to prevent such panics were ineffective or not used. Bank failures led to the loss of billions of dollars in assets.

After the panic ofand during the first 10 months ofU. banks failed, causes of the great depression. In all, 9, banks failed during the s. Bank failures snowballed as desperate bankers called in loans, causes of the great depression, which the borrowers did not have time or money to repay. With future profits looking poor, capital investment and construction slowed or completely ceased. In the face of bad loans and worsening future prospects, the surviving banks became even more conservative in their lending.

A vicious cycle developed and the downward spiral accelerated. The liquidation of debt could not keep up with the fall of prices it caused. The mass effect of the stampede to liquidate increased the value of each dollar owed, relative to the value of declining asset holdings. The very effort of individuals to lessen their burden of debt effectively increased it. Paradoxically, the more the debtors paid, the more they owed. Fisher's debt-deflation theory initially lacked mainstream influence because of the counter-argument that debt-deflation represented no more than a redistribution from one group debtors to another creditors.

Pure re-distributions should have no significant macroeconomic effects. Building on both the monetary hypothesis of Milton Friedman and Anna Schwartz as well as the debt deflation hypothesis of Irving Fisher, Ben Bernanke developed an alternative way in which the financial crisis affected output.

He builds on Fisher's argument that dramatic declines in the price level causes of the great depression nominal incomes lead to increasing real debt burdens which in turn leads to debtor insolvency and consequently leads to lowered aggregate demanda further decline in the price level then results in a debt deflationary spiral.

According to Bernanke, a small decline in the price level simply reallocates wealth from debtors to creditors without doing damage to the economy.

What Caused the Great Depression? (with Captions)

, time: 2:59Causes of the Great Depression by Lauren Foehr

Causes of Great Depression. Stock Market Crash of October 24th - Corporations sold and people invested in stocks (having a share in the company) - During the s stocks were profitable because businesses were growing - With the Recession stocks began to loose value as a result there Explain some theories of the causes of the Great Depression (from lecture). Briefly summarize the Depression’s effects on the American economy (ex. banking/stocks, employment, etc)? Major theories: unequal income distribution=wages and salaries did not keep pace with the sharp rise in industrial productivity, corporate profits, and dividends.. Deficiencies in corporate structure: banks Jul 21, · “Some economists believe that the large decline in the U.S. money supply was the primary cause of the Great Depression of the s.” Explain how this can be the case

No comments:

Post a Comment